Introduction

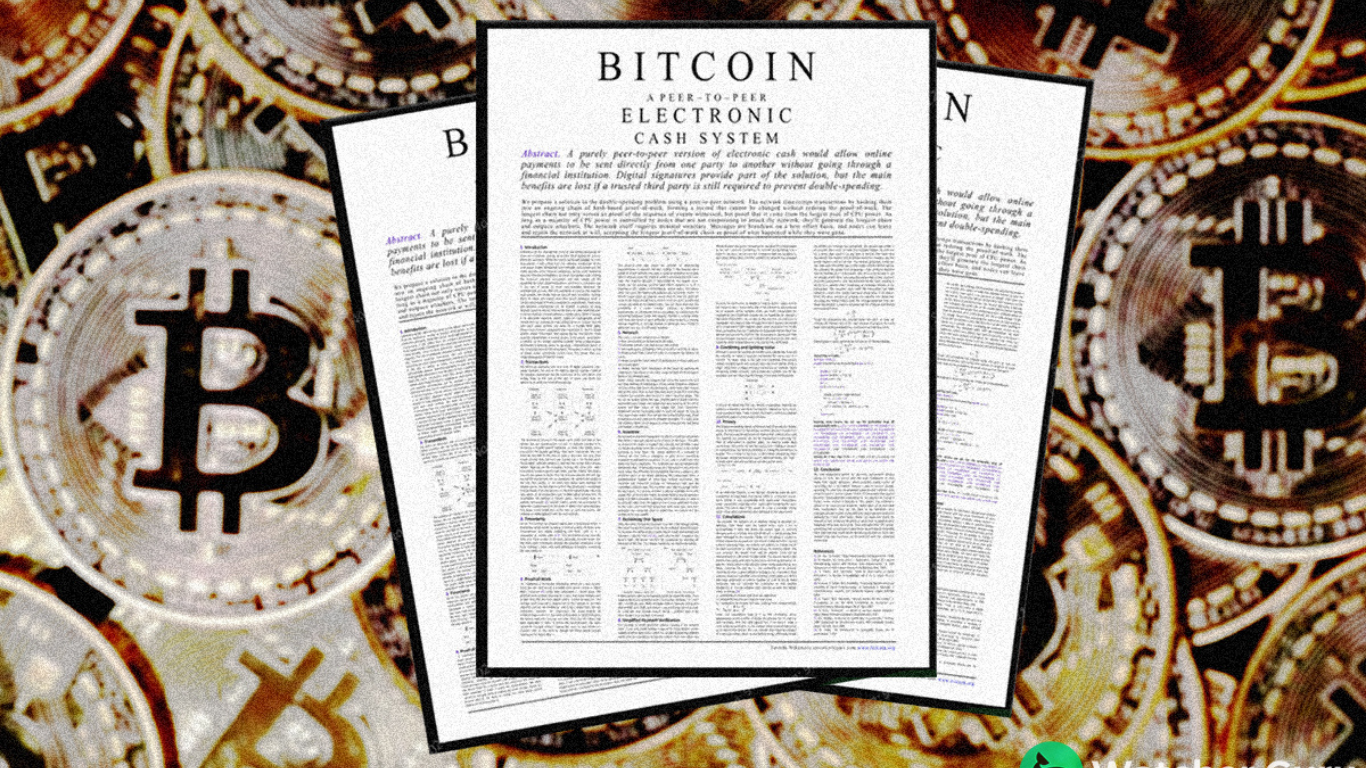

On October 31, 2008, an anonymous figure (or group) named Satoshi Nakamoto published a 9-page whitepaper titled:

“Bitcoin: A Peer-to-Peer Electronic Cash System”

This document introduced the first decentralized digital currency, solving long-standing problems in digital payments.

Why Was the Whitepaper Revolutionary?

✔ Eliminated trusted third parties (banks, governments).

✔ Solved double-spending without a central authority.

✔ Introduced blockchain technology—a tamper-proof public ledger.

This article breaks down the whitepaper’s key concepts, innovations, and lasting impact on finance.

1. The Core Problem: Trust in Digital Payments

Before Bitcoin, digital payments required centralized intermediaries (e.g., PayPal, banks) to:

- Verify transactions.

- Prevent double-spending (spending the same money twice).

Why Centralization Was Flawed

- Censorship: Banks could freeze accounts.

- Fees: High transaction costs.

- Fraud risk: Chargebacks and reversals.

Satoshi’s Solution: A decentralized network where users enforce rules via cryptography & consensus.

2. Key Innovations in the Bitcoin Whitepaper

A. Blockchain: The Public Ledger

- A chronological chain of blocks containing transactions.

- Immutable: Once recorded, data cannot be altered.

- Transparent: Anyone can audit transactions.

B. Proof-of-Work (PoW): Securing the Network

- Miners compete to solve complex math problems.

- The first to solve it adds a new block and earns Bitcoin rewards.

- Makes attacks extremely expensive (51% attack problem).

C. Decentralized Consensus

- No single entity controls Bitcoin.

- Nodes (computers) follow the longest valid chain rule.

- Incentives: Miners earn BTC; users get secure transactions.

D. Fixed Supply & Halving

- Only 21 million BTC will ever exist.

- Halving events (every 4 years) reduce new supply, mimicking digital scarcity like gold.

3. Breaking Down the Whitepaper’s Key Sections

Section 1: Introduction

- Identifies the double-spending problem.

- Proposes a peer-to-peer (P2P) solution using cryptographic proof.

Section 2: Transactions

- Explains how digital signatures authorize payments.

- Transactions are broadcast to the network but not immediately final.

Section 3: Timestamp Server (Blockchain)

- Introduces the concept of blocks linked via hashes.

- Each block contains a reference to the previous one, creating an unbreakable chain.

Section 4: Proof-of-Work (Mining)

- Describes how miners compete to validate transactions.

- Adjusting difficulty ensures one block every ~10 minutes.

Section 5: Network

- Explains how nodes communicate.

- The longest chain = the valid one (prevents fraud).

Section 6: Incentives

- Miners earn block rewards + transaction fees.

- Early adopters benefit from BTC’s rising value.

Section 7: Reclaiming Disk Space (Simplified Payment Verification)

- Lightweight wallets don’t need the full blockchain.

- Uses Merkle trees for efficient verification.

Section 8: Privacy

- Bitcoin is pseudonymous (addresses, not names).

- Unlike banks, transactions are transparent but not directly tied to identity.

Section 9: Conclusion

- Summarizes Bitcoin’s decentralized, trustless model.

- Declares it “practical and enforceable”.

4. How Bitcoin Changed Finance Forever

A. Birth of a New Asset Class

- Digital gold: Scarcity + decentralization = store of value.

- Institutional adoption (Tesla, MicroStrategy, ETFs).

B. Blockchain Beyond Bitcoin

- Ethereum (smart contracts).

- DeFi (decentralized finance).

- NFTs (digital ownership).

C. Challenges & Criticisms

- Scalability: Slow transactions (7 TPS vs. Visa’s 24,000).

- Energy use: PoW mining consumes electricity.

- Regulation: Governments struggle to classify crypto.

5. Conclusion: The Whitepaper’s Lasting Legacy

Satoshi’s whitepaper wasn’t just about money—it was about freedom from centralized control.

Key Takeaways:

✅ Bitcoin proved decentralized money is possible.

✅ Blockchain is now a foundational tech (finance, supply chains, identity).

✅ The financial system will never be the same.

Want to explore more? Let me know if you’d like a deep dive into:

- How mining works (step by step).

- Ethereum vs. Bitcoin.

- The future of DeFi.

FAQs

Q: Did Satoshi invent blockchain?

A: No—the concept existed earlier, but Bitcoin combined it with PoW for decentralization.

Q: Can Bitcoin be hacked?

A: The network is highly secure, but exchanges/wallets can be vulnerable.

Q: How many people have read the whitepaper?

A: Millions—it’s one of the most influential tech documents in history.